Tokenomics

DCA Token

DCA (pronounced as “hue”) is the native token of Decision AI Protocol. The maximum supply is 1,000,000,000. DCA token provides a default mechanism to store and exchange value in the Decision AI ecosystem. The utilities include:

Pay for compute resources

Stake to secure the network and earn protocol fees

Vote on governance decisions

Serve as the gas token for transactions in the Decision AI Chain Dynamic Emission for Compute Providers

50% of total DCA token supply (excluding season 1 testnet mining) are allocated to protocol emissions, designed to ensure the supply of compute resources and attract new community members, similar to Proof of Work (PoW) mining. However, DePIN protocols like Decision AI differ from PoW systems in one crucial aspect: the physical resources supplied (in Decision AI case, GPUs) should match the real demand for these resources. Decision AI balance the compute supply with the demand by controlling the protocol emission rate based on protocol revenue, defined as the sum of compute payments from users.

Before the mainnet is activated and a continuous emission is implemented (miners get token rewards per block), we plan to allocate pre-mainnet mining rewards in 3 phases.

Phase 1: 5% of total token supply airdropped to all miners at a snapshot taken at July 19th, 2024. See Season 1 (Ended)

Phase 2: a dynamic amount of tokens, min 400,000 per week and max 2,000,000 per week, accumulated to all miners at weekly snapshots. See Season 2 (Ongoing)

Phase 3: a dynamic amount of tokens (amount TBD) accumulated to all miners in a continuous stream.

The data and insights collected from each phase will be critical to help calibrate and determine the mainnet emission mechanism.

After these 3 phases, mainnet emission will go live. Team and the protocol governance houses reserve the right to adjust the following emission schedules.

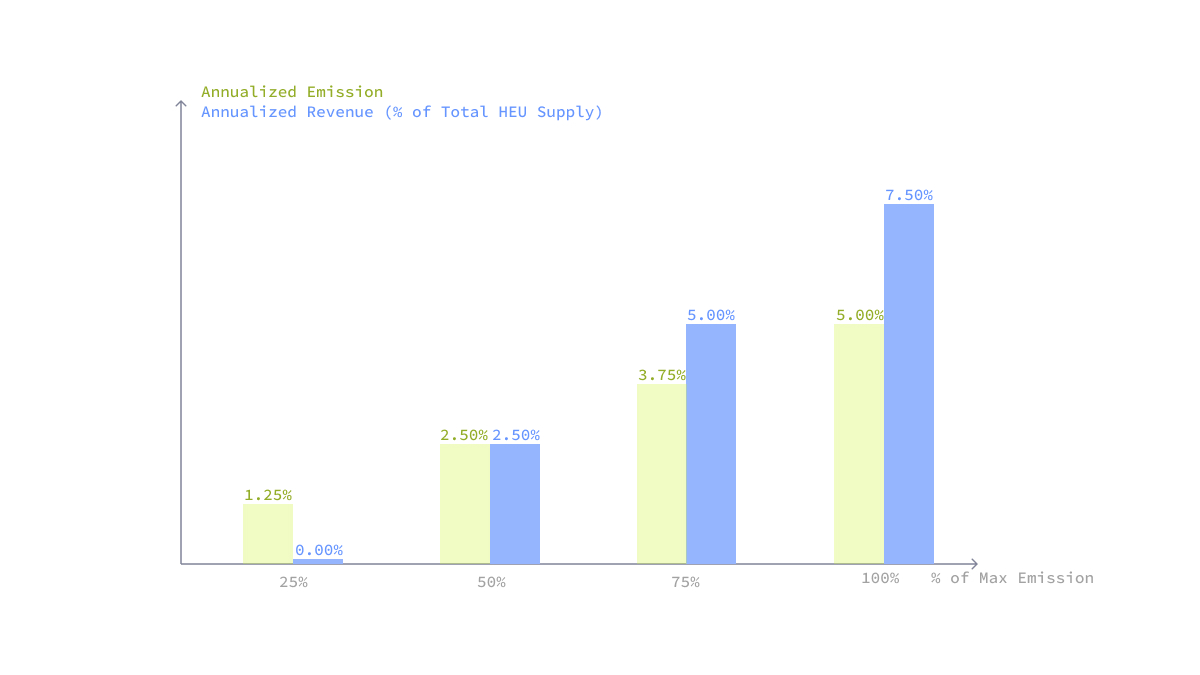

The emission rate of mainnet is determined by two parameters

Maximum emission rate: 5% per year

Baseline emission rate: 1.25 per year

The actual emission rate is dynamically decided by the protocol revenue.

During periods of low demand, the lower emission rate prevents oversupply of resources. As demand increases, the rising emission rate attracts more providers to the network. This dynamic emission mechanism aims to achieve elasticity in both token distribution and compute resource provision by providing a flexible and responsive way to incentivize network participation.

Last updated